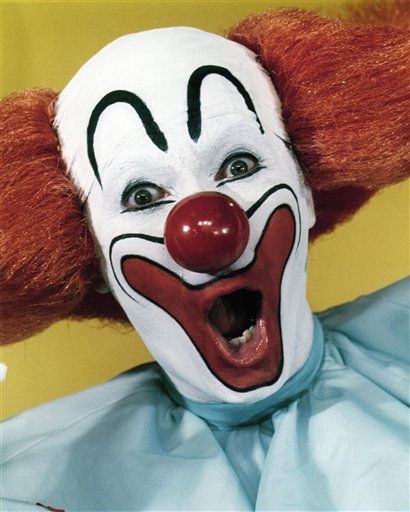

When the Smartest Guy in the Room Looks Like Bozo the Clown

Harvard Derivatives Hedging Strategy Backfires to the tune of $500 million

Larry Summers Hard at work. It's very tiring to be a genius, your mind never rests

"Bozo The Clown"--Genius

Transparency, schmansparency. Not even the high-Q of Larry Summers is enough intelligence to avoid looking like a schmuck... at least in hindidght. Seems the geniuses at Harvard had a conviction that interestes were heading north. So to hedge their interest rate exposure, they entered into a series of interest rate swaps to synthetically "lock-in" a fixed rate against their anticipated Capital Projects Campaign that would be funded trough floating rate bonds. A pretty intelligent and "correlative hedging" startegy and an apprpriate use of derivative proucts. But they still managed to talke a $500 million hit (that we know about) to unwind it's position.

Transparency, schmansparency. Not even the high-Q of Larry Summers is enough intelligence to avoid looking like a schmuck... at least in hindidght. Seems the geniuses at Harvard had a conviction that interestes were heading north. So to hedge their interest rate exposure, they entered into a series of interest rate swaps to synthetically "lock-in" a fixed rate against their anticipated Capital Projects Campaign that would be funded trough floating rate bonds. A pretty intelligent and "correlative hedging" startegy and an apprpriate use of derivative proucts. But they still managed to talke a $500 million hit (that we know about) to unwind it's position.

SO WTF happened. I'll tell you what. The wheels came off the car driving down the highway at 70 mph. Or at least one leg fell of the stool. I'll let the investigative pundits try to reconstruct or deconstruct how even the smartest guys can't manage the risk of products they don't really understand.

Lest you think I am not clairvoyant, I will predict that this was a combination of not only rates dropping precipitously (due tot he fianancial crisis), a cancellation of the projects (due to the financial crisis) massive investment losses in the alternative investments portfolio (due to the financial crisis) and something known as basis risk (hedge variable rate demand products that have weird results when spreads go wild (due to the fiancial crisis).

So it's a good thing that Harvard was able to remove the risk manager , Larry Summers -- he was kinda like the CEO. Glad he is watching the economy and the financial markets on behalf of all of us instead of just the Harvard Treasury.

Q: Ho do you sit on a three legged- stool when one of the legs breaks off?

A: You just turn it upside down.