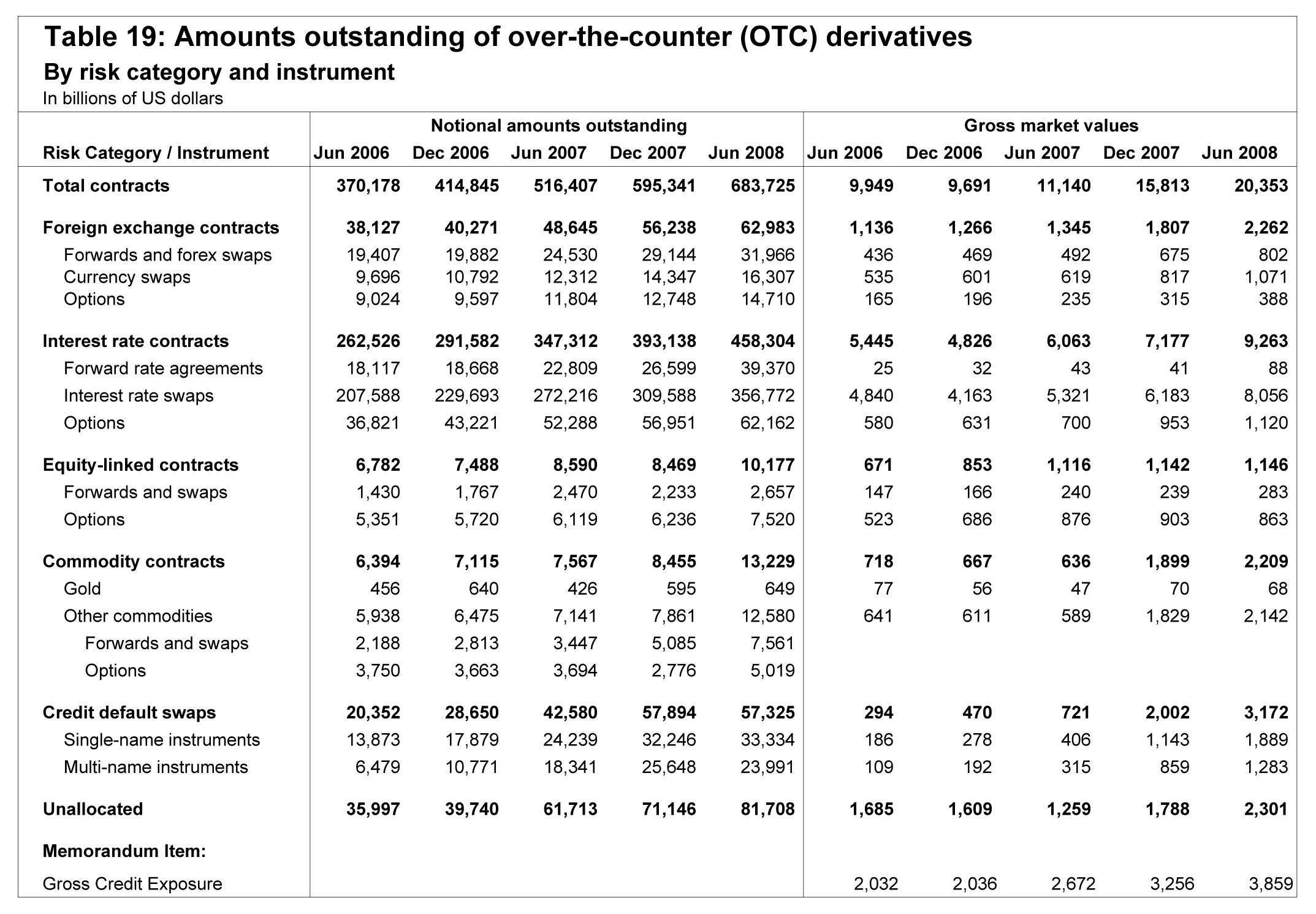

Caveat Emperor: Be Sure to Read Table 19

Outstanding Global Derivatives Exceeds $658 Trillion.

That's right-- $658 Trillion not Billion!

Download Full PDF at: http://www.bis.org/statistics/otcder/dt1920a.pdf

The arcane world of unregulated derivatives has trumped even Hans Christian Anderson's delightful fable called- as every child knows- the "Emperor's New Clothes". Wanna know why there is fear in the streets or at least why there should be? Just look at the Bank for International Settlements June '08 Report on the OTC Derivatives as voluntarily reported by "market participants". First of all, voluntary information from "market participants" is crap. It's like asking someone in public "how many times a week do you beat your wife?" Or a hot chic who expects that her "official" campus sex survey form that she filled out on the porch of Delta House will remain confidential.

I don't know about you by every time I hear that nasty little phrase, "credit default swaps" or CDS my sphincter starts to invert. And it always seems to be accompanied by that really,really scary number: $60 trillion. Holy Mother of Merde (hereinafter referred to as H-MOM) !!!! Do you have any idea how big $60 trillions? The entire GDP of the US is $14 trillion and China is a mere pittance at $3 plus trillion. Every time one price changes in the market place/universe every other pricing relationship also changes. It's kinda like gravity of which we know everything about except why it exists (thank you Buckminster Fuller).

So take $60 trillions in CDS and now overlay total global derivative products as per BIS Table 19 and you've got $658 trillion of toxicity simply because no one in charge has a clue as to what any of it means. I've yet to meet a politician, regulator or CEO of a financial institution who has a) ever executed a derivative transaction; b) has ever read a derivatives contract; c) if they did read a derivatives contract would have any idea what it said; d) can possibly explain or calculate the risk entailed in this tiny little over-the-counter unregulated $700 trillion market. Why don't we just ship some enriched plutonium to Osama Bin Laden? It might be safer.It's not that all derivatives are bad...it's just gotten completely out of control and assessing the risk is so damn complicated compounded by the little annoying fact that no one in charge understands any of it. As Jamie Dimon said "what on earth were we thinking!"

The experts say "$658 trillion! Don't be ridiculous!That's not the real exposure. That's the notional amount, not the "gross" market value. We must look at the "net" exposure."Net shmet my ass! Well, If you don't understand it or can't explain it in Congressional Testimony we shouldn't be doing it at least where taxpayer money is the lender of last resort.

Here is an excerpt from a most excellent article from December, 2008 Atlantic magazine entitled, "Be Nice to the Countries That Lend You Money. (http://www.theatlantic.com/doc/200812/fallows-chinese-banker) It is an interview with China Investment Corporation's Gao Xiqing, the man who oversees $200 billion of higher risk investments of China’s $2 trillion in dollar holdings. American trained he's the man who makes the big decisions for China's corporate investments in the U.S.and is the prime Sino-financial strategist With those very attractive U.S. treasury yields approaching zero you can expect to hear more about and from Gao in the future. (big hint: He doesn't invest in treasuries and he ain't too keen on the dollar either!)

Here is a wonderful excerpt on how Gao tried to explain derivatives to China's State Council:

If you look at every one of these [derivative] products, they make sense. But in aggregate, they are bullshit. They are crap. They serve to cheat people.

I was predicting this many years ago. In 1999 or 2000, I gave a talk to the State Council [China’s main ruling body], with Premier Zhu Rongji. They wanted me to explain about capital markets and how they worked. These were all ministers and mostly not from a financial background. So I wondered, How do I explain derivatives?, and I used the model of mirrors.

First of all, you have this book to sell. [He picks up a leather-bound book.] This is worth something, because of all the labor and so on you put in it. But then someone says, “I don’t have to sell the book itself! I have a mirror, and I can sell the mirror image of the book!” Okay. That’s a stock certificate. And then someone else says, “I have another mirror—I can sell a mirror image of that mirror.” Derivatives. That’s fine too, for a while. Then you have 10,000 mirrors, and the image is almost perfect. People start to believe that these mirrors are almost the real thing. But at some point, the image is interrupted. And all the rest will go.

When I told the State Council about the mirrors, they all started laughing. “How can you sell a mirror image! Won’t there be distortion?” But this is what happened with the American economy, and it will be a long and painful process to come down.

I think we should do an overhaul and say, “Let’s get rid of 90 percent of the derivatives.” Of course, that’s going to be very unpopular, because many people will lose jobs.

So there you have it. Ninety percent of all derivatives is a bunch of crap. George Soros agrees

with Gao and so do I. Derivative are appropriate for hedging activities and capital raising activites in well-define transactions. In other words they have to be attached to some product or some underlying transaction (fixing the rate on floating rate borrowings or borrowing in yen and converting to dollars. In other words no naked positions no trading -- at least not at institutions where tax payer money is at risk which is soon to be all. Want to speculate? Try Atlantic City or Vegas. Knock yourselves out.

So how do we untangle this mess of $658 trillion of derivatives. I'm working on. Got a few ideas. See you at the great unwind. Caveat Emperor.